Announcements

The IPVA (Motor Vehicle Ownership Tax) consultation is an essential annual task for car owners in Brazil.

In 2024, technology simplified this process even further with the availability of apps that allow quick queries and easy payments.

Announcements

With this facility in mind, we've listed the 5 best apps for consulting IPVA. In addition, we show you other ways to do this, how to get tax exemption, and the 2024 payment schedule. Read on!

Read also: Check Vehicle License Plate Number: Discover the best Apps!

top 5 apps to check IPVA 2024

1. zapay

O Zapay is an application accredited by the federation's 27 Detrans, offering a practical platform for consulting and paying debts such as traffic fines and taxes, including IPVA.

Announcements

To use the service, simply search for the license plate of the vehicle. Payment options include Pix or credit card, with the possibility of paying in installments.

Additional Zapay Features

As well as making it easier to pay debts, Zapay offers additional features for managing taxes and traffic fines.

Users can track new debts and receive personalized alerts, ensuring they don't miss important deadlines.

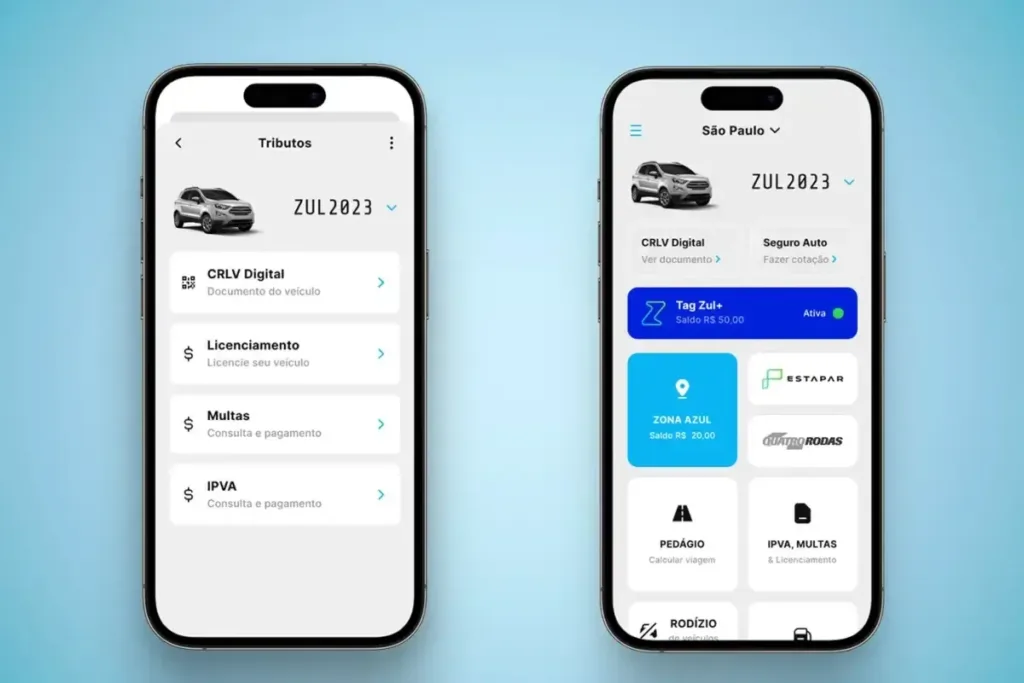

2. Gringo

O Gringo is an application that offers a complete solution for drivers. In addition to allowing the payment of IPVA and other vehicle debts, the app resolves licensing issues, fines, and offers the digital CRLV in one place.

Payment Options at Gringo

Drivers can pay with Pix, boleto or up to 12 times by credit card. For those who need a longer term, Gringo offers the option of requesting a loan for payment in up to 60 installments.

Vehicle Insurance

Another interesting feature of Gringo is the possibility of finding insurance for motorcycles and cars of all makes, years and models.

The app offers insurance with and without a deductible, giving users greater flexibility.

3. Veloe

Although Veloe is best known for its tag that allows you to go straight through tolls and parking lots, the app also makes it easy to pay vehicle debts, including IPVA, DPVAT, licensing and fines.

Paying debts on Veloe

The app allows debts to be paid in up to 12 installments, using the Zapay guarantee. The debts can be consulted directly using the vehicle's license plate, without the need for new downloads or additional registrations.

4. BrasilCar: IPVA, Taxes, Fines

O BrasilCar is a multifunctional application that offers various vehicle-related queries. In addition to IPVA queries, the app allows you to check the price of vehicles in the Fipe Table, access technical data sheets, check stolen vehicles and calculate the ideal fuel through a smart calculator.

BrasilCar features

- Vehicle Price Consultation (Fipe Table)

- Technical file consultation

- Stolen Vehicle Search

- Consultation of IPVA, License Plate, Fines, Licensing and Fees of All States of Brazil

- Fuel Calculator

5. PicPay

O PicPay is a financial services app that also offers the option of consulting, paying and managing vehicle debts, such as fines and IPVA. Payments can be made in up to 12 installments.

Using PicPay to Pay IPVA

To pay your IPVA on PicPay, simply click on "pagar boleto", select "fines and IPVA" and enter your license plate number.

Next, choose the debts to be settled and select the desired payment method, which can be credit card or wallet balance.

Alternative Means to Consult the IPVA

In addition to the apps mentioned above, you can check your IPVA on the Detran website or on the website of the Finance Department of the state where the vehicle is registered.

The process involves clicking on the "IPVA" service tab and selecting "consulta de débitos". The vehicle is identified by its RENAVAM number and license plate.

IPVA Consultation by License Plate

On the websites of the state Detrans, the IPVA can't be consulted by vehicle license plate alone. However, it is possible to do this on the Denatran website.

After accessing the service portal and registering, click on "vehicles" and fill in the requested data, including serial number, QR code and license plate number.

IPVA exemption

People with disabilities, owners of cars more than 10 years old and public transport are entitled to exemption from IPVA.

Exemptions can be consulted via the Detran and Finance Department portals and the apps mentioned above.

| Production time | State |

|---|---|

| 10 years | Amapá, Rio Grande do Norte and Roraima |

| 15 years | Federal District, Rio de Janeiro, Amazonas, Bahia, Ceará, Espírito Santo, Paraíba, Pará, Maranhão, Rondônia, Sergipe, Piauí and Tocantins |

| 18 years old | Mato Grosso |

| 20 years | São Paulo, Mato Grosso do Sul, Acre and Alagoas |

| 30 years | Santa Catarina and Pernambuco |

Calculating the IPVA Value in 2024

The value of the IPVA is not fixed and varies according to the model and year of manufacture of the vehicle, as well as the state where it is registered.

The rate can vary between 1% and 6%. States such as São Paulo, Rio de Janeiro and Minas Gerais apply a rate of 4%.

Steps to Calculate IPVA

- Consult the vehicle's retail value: Use the Fipe Table to check the average price of a car sold in the country, taking into account make, model, version and year of manufacture.

- Apply the State RateMultiply the retail value by the IPVA rate of the state where the vehicle is registered.

Example of rates by state

| State | Passenger cars | Trucks and Utility Vehicles | Motorcycles |

|---|---|---|---|

| Acre | 2% | 1% | 1% |

| Alagoas | 3% | 3,25% | 2,75% |

| Amapá | 3% | 3% | 1,5% |

| Amazonas | 3% | 3% | 2% |

| Bahia | 2,5% | 2,5% | 2,5% |

| Ceará | 3% | 3% | 2% |

| Federal District | 3,5% | 1% | 2% |

| Holy Spirit | 2% | 2% | 1% |

| Goiás | 3,75% | 3,45% | 3% |

| Maranhão | 2,5% | 2,5% | 1% |

| Mato Grosso | 3% | 2,5% | 1% |

| Mato Grosso do Sul | 3,5% | 3,5% | 2% |

| Minas Gerais | 4% | 3% | 2% |

| Pará | 2,5% | 2,5% | 1% |

| Paraíba | 2,5% | 2,5% | 2,5% |

| Paraná | 3,5% | 3,5% | 3,5% |

| Pernambuco | 3% | 3% | 2,5% |

| Piauí | 2,5% | 2,5% | 2% |

| Rio de Janeiro | 4% | 3% | 2% |

| Rio Grande do Norte | 3% | 3% | 2% |

| Rio Grande do Sul | 3% | 3% | 2% |

| Rondônia | 3% | 3% | 2% |

| Roraima | 3% | 2% | 2% |

| Santa Catarina | 2% | 2% | 1% |

| São Paulo | 4% | 2% | 2% |

| Sergipe | 2,5% | 2,5% | 2% |

| Tocantins | 2% | 3% | 2% |

IPVA Payment Schedule 2024

Each Brazilian state sets its own IPVA payment schedule, with deadlines, due dates and discounts applicable to cash payments.

It's essential to check the website of the Finance Department or Detran of the state where the vehicle is registered for up-to-date information.

Examples of Calendars by State

| State | Due Date 1st Discounted Lot | Discount Percentage |

|---|---|---|

| Acre | From 31/1 to 30/8, according to the end of the vehicle's license plate | 10% |

| Alagoas | Until 31/1. After that date, payment in a lump sum or in installments, with a discount of 5%, continues only for vehicles belonging to owners registered with the Nota Fiscal Cidadã (Citizen's Tax Receipt) | 5% |

| Amapá | Until 15/3 | 20% |

| Amazonas | From 31/1 to 31/10, according to the end of the vehicle's license plate | 10% |

| Bahia | Until July 31st, according to the end of the vehicle's license plate | 15% (until 7/2) and 8% (until 31/7) |

| Ceará | Until 31/1 | 5% |

| Federal District | Until 19/1 | No discount |

| Holy Spirit | Between 9/4 and 15/4, depending on the end of the vehicle's license plate | 15% |

| Goiás | From 9/1 to 19/1, depending on the end of the license plate | 7% |

| Maranhão | Until 29/2 | 10% |

| Mato Grosso | Until 29/5 | 10% |

| Mato Grosso do Sul | Until 31/1 | 15% |

| Minas Gerais | Between 15/1 and 19/1, depending on the end of the vehicle's license plate | 3% (plus 3% discount granted by the Bom Pagador program) |

| Pará | From 8/1 to 23/9, depending on the end of the license plate | 15% (vehicles with no traffic fines in the last two years), 10% (vehicles with no traffic fines in the previous year) and 5% (other situations) |

| Paraíba | Between 31/1 and 31/10, depending on the end of the vehicle's license plate | 10% |

| Paraná | Between 17/1 and 23/1, depending on the end of the vehicle's license plate | 6% |

| Pernambuco | From 5/2 to 25/2, depending on the end of the license plate | 7% |

| Piauí | Until 29/2 | 15% (until 31/1) and 10% (until 29/2) |

| Rio de Janeiro | Between 22/1 and 2/2, depending on the end of the vehicle's license plate | 3% |

| Rio Grande do Norte | From 11/3 to 10/6, according to the end of the vehicle's license plate | 5% |

| Rio Grande do Sul | 28/12/2023, 31/1/2024, 29/2/2024 and 28/3/2024, with different discounts | Up to 28% for payment by 29/12/2023 and up to 20.8% for payment by 31/3/2024 |

| Rondônia | From 31/1 to 30/8, according to the end of the vehicle's license plate | 10% |

| Roraima | Until 29/2 | 10% |

| Santa Catarina | From 31/1 to 31/10, according to the end of the vehicle's license plate | Not disclosed |

| São Paulo | Between 11/1 and 24/1, depending on the end of the vehicle's license plate | 3% |

| Sergipe | Until 27/3 | 10% |

| Tocantins | Until 15/1 | 10% |

Conclusion

Consulting and paying the IPVA in 2024 has become easier with the help of specialized apps. With these options, drivers have a variety of methods at their disposal to keep up to date with their tax obligations, avoiding fines and legal complications.

Whether using an app or government portals, it's essential to be aware of the specific deadlines and amounts in your state to ensure a smooth process with no surprises.

With the information provided in this article, you're ready to face the IPVA 2024 efficiently and without complications.