Announcements

Managing personal finances is a constant challenge, but as technology advances, there are several applications at our fingertips that make this task easier and more efficient.

In 2023, we highlighted the 8 best financial control apps for Android and iOS designed to simplify and improve your money management.

Announcements

In this comprehensive guide, we'll explore the individual features of each app so you can choose the one that best suits your needs and financial goals.

Read also | Discover the 5 Best Security Apps for Smartphones!

8 best financial control apps for cell phones

1. Mobills :

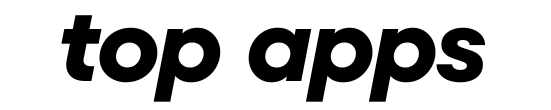

Mobills is a complete solution with over 300,000 positive reviews. Available for Android, iOS and web, stands out for its holistic approach.

In addition to synchronization between cloud environments, Mobills offers features such as credit card management, financial planning, advanced graphics and integration with various banking institutions.

By subscribing to Mobills Premium, in addition to exclusive features, you have access to various training materials that prove that the application is the perfect tool for improving your financial information.

2. Easy budgeting:

Easy Budgeting, also known as Fast BudgetIt stands out for its simplicity.

By offering personalized financial control features, this application allows you to customize your home page to highlight the most important information.

With features such as bank synchronization, transaction notifications and support for up to five devices, Orçamento Fácil offers an intuitive experience and is a good option for those who want to work on day-to-day financial management.

3. Organize:

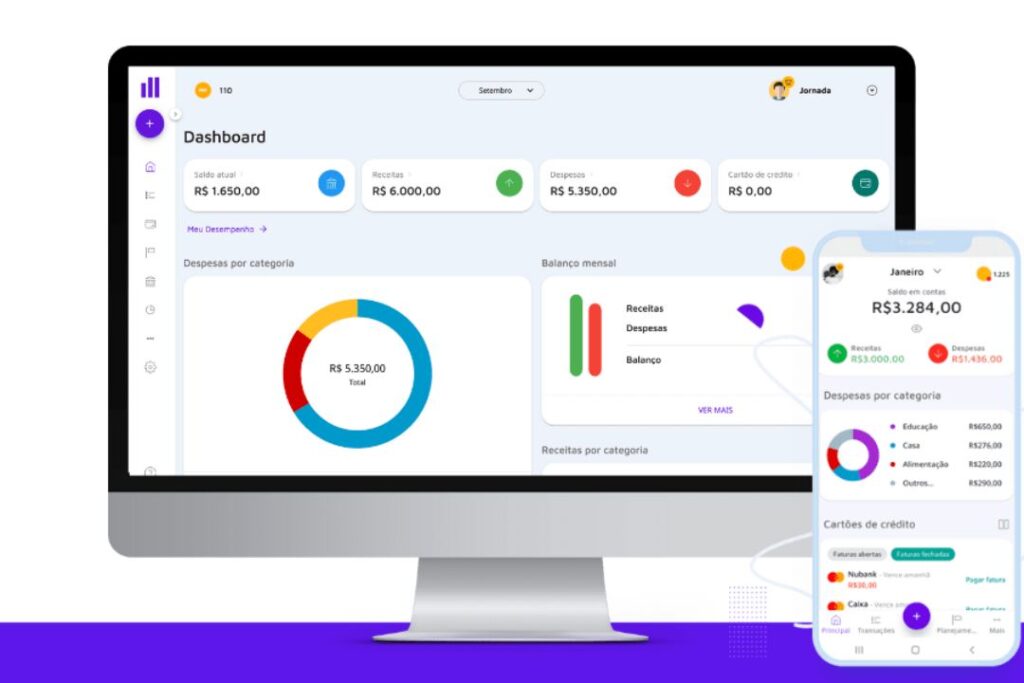

Organizze is an option that allows integrated analysis of multiple accounts.

With monthly statements and detailed classifications, it gives you a complete overview of your budget. In addition, Organze stands out for its ease of use and elegant design.

Available on various platforms, including offline, the program offers a solid experience for those who value detailed and efficient financial management.

4. My Savings:

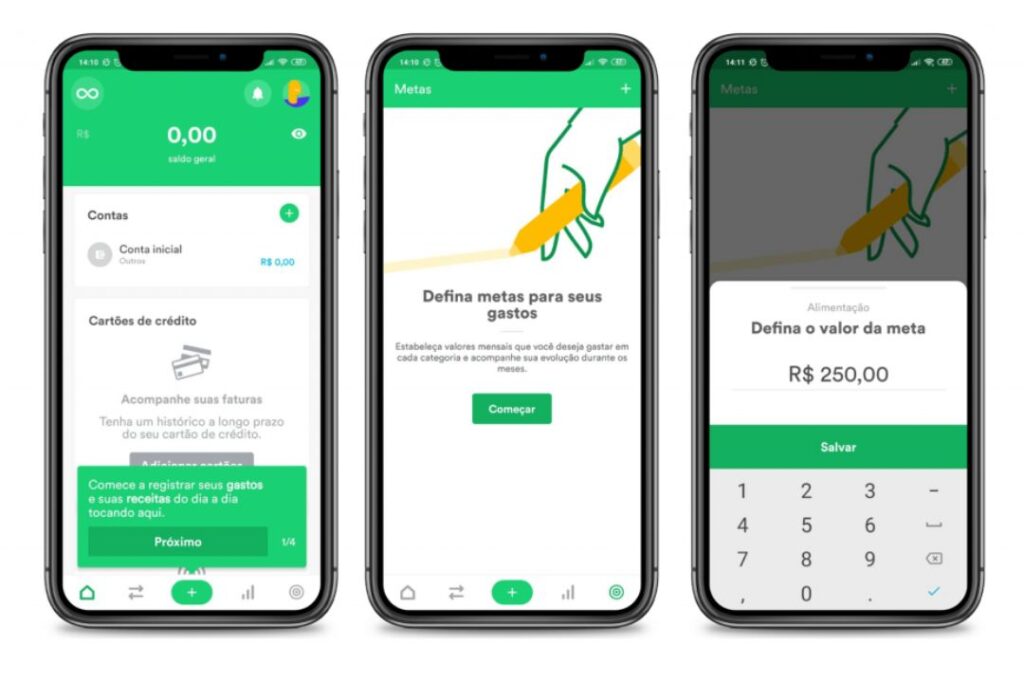

Minhas Economias not only helps you keep your budget up to date, but also allows you to plan your finances for the future.

In addition to the basic control of expenses and income, the application offers comparative analyses of funds and financial indicators.

Its dream manager feature helps you plan medium- and long-term goals, making Minhas Economias a comprehensive and efficient choice.

5. Money Lover:

Money Lover makes it possible to intelligently segment the monthly budget into different categories, adapting to each user's routine.

With the "Travel Mode" feature, you can record expenses in local currencies during international trips.

The premium version of the application offers additional features, including the web version and invoice reminders, providing a personalized and organized experience for the modern user.

6. Monefy:

Monefy stands out for its flexibility in allowing you to analyze reports according to the periodicity you choose.

Contrary to the norm of only generating monthly reports, Monefy offers users the freedom to customize their financial analysis.

With a free version available for all platforms, and a premium version for Android users, the app features an intuitive graph that provides an enlightening view of finances.

7. Expenses - Budget Manager:

The Expenses - Budget Manager application offers an efficient account control experience.

With detailed reports by period and category, the user can add transactions in a simple way, viewing a graph with the spending pattern.

Its clear interface, multi-currency support and the ability to create passwords to ensure privacy make it a robust option for anyone looking for clarity and efficiency in financial control.

8. CoinKeeper:

Although it is not Brazilian, CoinKeeper has a Portuguese version and stands out for its color-based visual organization.

The application works with an interesting color system, allowing users to structure an effective visual organization.

The free version offers a 15-day trial, after which it is necessary to purchase the premium version for U$ 15.99 per year. This application is an option for those looking for a unique visual approach to financial management.

Personal and Business Financial Management: Pillars of Financial Success

In addition to monitoring personal financial management, it is important to understand the importance of monitoring company finances.

The former is related to monitoring expenses, creating budgets and saving, while the latter is necessary to guarantee the company's financial stability.

Corporate control requires organized financial management, cash flow monitoring and supervisory measures to ensure that the business is tax legal.

Why use software to monitor financial management?

We've already explored the best financial management software and understood the basics of day-to-day financial management. Now it's worth highlighting the practical benefits of a free personal finance management app.

From detailed tracking of expenses and income to efficient allocation of fixed and variable expenses, these apps offer features such as organizing expenses by category, planning future budgets, setting financial goals and much more.

How to use a financial manager? Tips for effective management

When choosing an app to manage your spending, it's important to understand its features.

Organizing expenses, creating expense estimates, scheduling bill alerts, synchronizing cards and bills, creating graphs and reports are just some of the main features of these programs.

Discipline in regular transactions and a way of tracking results are the key to building effective financial strategies.

By cultivating this discipline, we benefit from an organized and sustainable economic life. By choosing the app that best suits your needs, you'll not only simplify the daily control of income and expenses, but you'll also get the tools to achieve your financial goals, plan for the future and achieve a healthier financial life.

Remember that managing your finances isn't just about numbers, it's about being able to make informed decisions that shape your present and future.

By adding these programs to your routine, you will not only save money, but also create a solid foundation for achieving your financial goals.

So dive into this universe of practicality, organization and financial knowledge and enjoy a more informed and successful journey.